does cash app stock report to irs

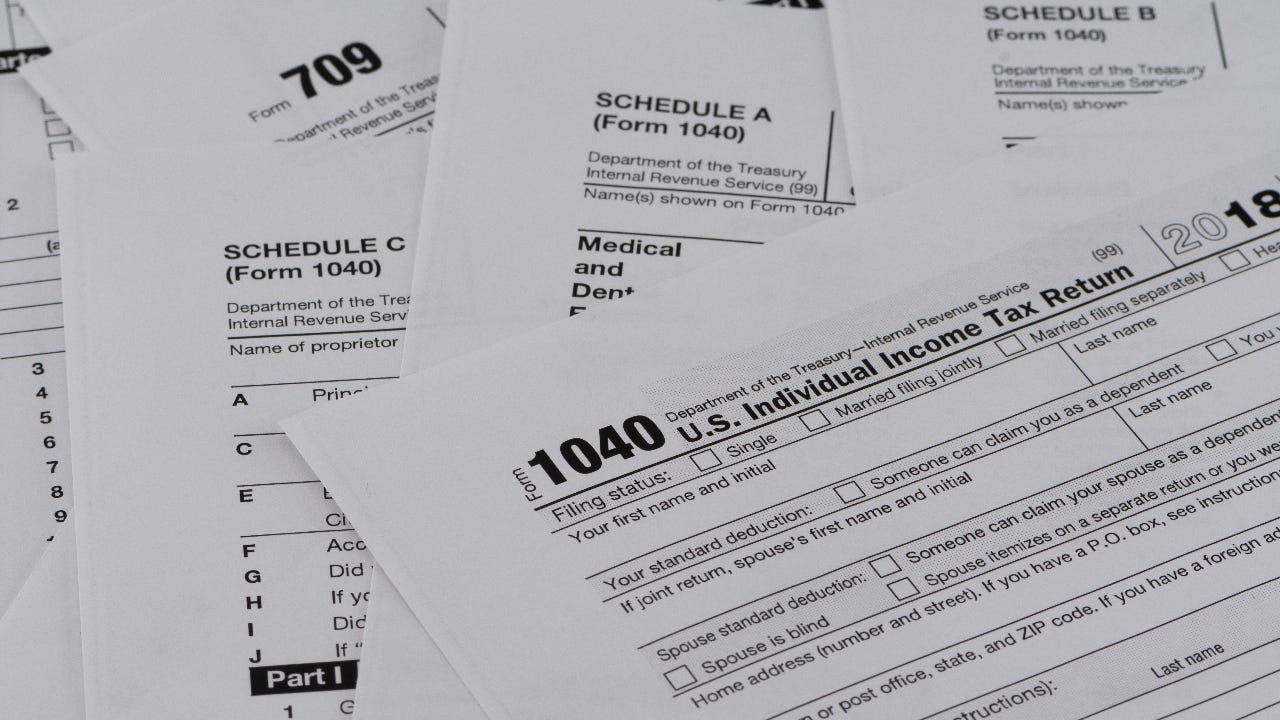

Make sure you fill that form out correctly and submit it on time. In this regard does Cashapp report to IRS.

Remember there is no legal way to evade cryptocurrency taxes.

. 1 the reporting threshold for business transactions processed through any cash apps is 600. Beginning this year Cash app networks are required to send a Form 1099. Cash App Support Tax Reporting for Cash App Certain Cash App accounts will receive tax forms for the 2021 tax year.

Any 1099-B form that is sent to a Cash App user is also sent to the IRS. Your gains losses and cost basis should automatically be calculated on a first-in-first-out basis on your. Federal law requires a person to report cash transactions of more than 10000 to the IRS.

The report doesnt identify which companies those are although it does mention several of the payment apps by way of context. The answer is very simple. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

There isnt any new Cash App tax for 2022. Cash App Investing is required by law to file a copy of the Form Composite Form 1099 to the IRS for the applicable tax year. Cash app investing is required by law to file a copy of the form composite form 1099 to the irs for the applicable tax year.

Does Cash App report to the IRS. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year. An FAQ from the IRS is available here.

Those who use cash apps for personal use. By Tim Fitzsimons As of Jan. Certain Cash App accounts will receive tax forms for the 2018 tax year.

Some businesses or sellers who receive money through cash apps may not have been reporting all the income. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. Before the new rule business transactions were only reported if they were.

How do I calculate my gains or losses and cost basis. Now cash apps are required to report payments totaling more than 600 for goods and services. Before the new rule business transactions were only.

The IRS wants to make sure theyre getting their cut of taxes. Here are some facts about reporting these payments. Log in to your Cash App.

Log in to your Cash App Dashboard on web to download your forms. Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS. Currently cash apps are required to send forms to users if their gross income is 20000 more or if they have 200 separate transactions within a calendar year.

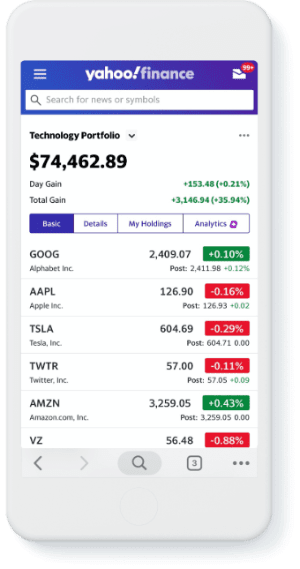

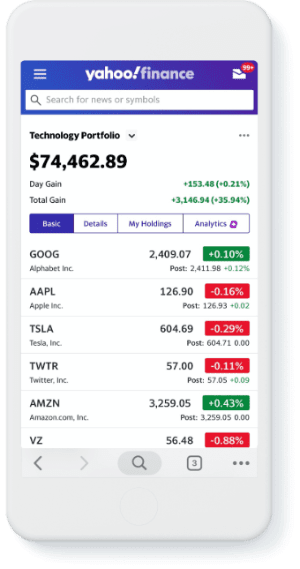

Whos covered For purposes of. Tax Reporting for Cash App. How does Cash App report stock transactions.

PayPal and Cash App to report to the IRS on money that goes in and out of accounts with values of at least 600. Form 1099-K Payment Card and Third Party Network. Cash App will also provide a copy of the 1099-B to the IRS for the applicable tax year.

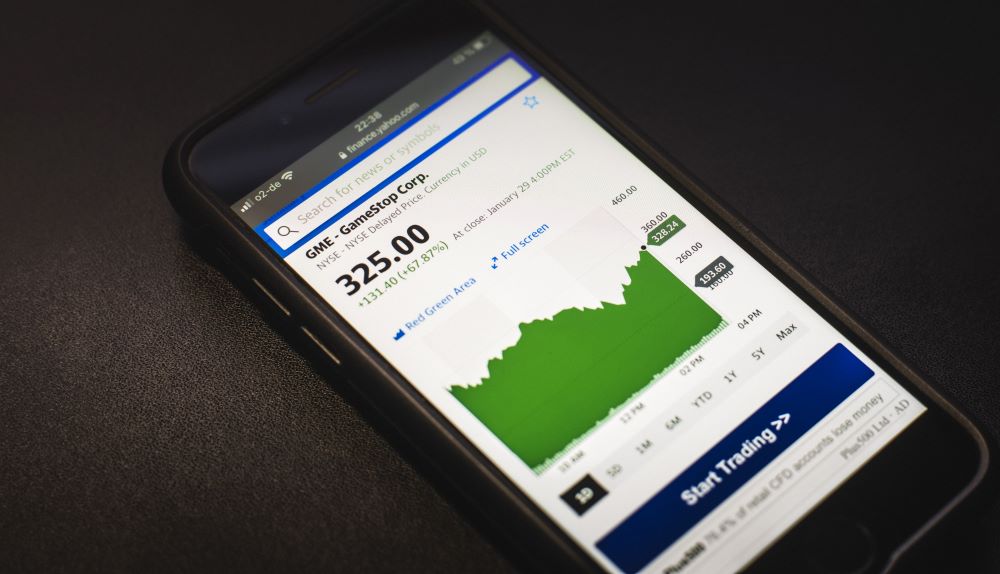

And the IRS website says. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. If you sold stocks and received 10 or more in dividends youll.

Previous rules for third-party payment systems. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS. What Does Cash App Report to the IRS.

Freeze Your Credit Instead Of Messing With Equifax S New App Identity Theft App Equifax Credit Report

How Do You Pay Taxes On Robinhood Stocks Picnic S Blog

Trade Stocks These Forms Are Required To File Your Tax Return Gobankingrates

New P2p Tax Laws Of 2022 In The Us Simplified Compareremit

Financial Terms Dictionary Financial Stock Market Investing Word Choice

Pin By Marcus S On Mobile Solutions Financial Wellness Mobile Solutions How To Get Money

How To Deduct Stock Losses From Your Taxes Bankrate

Stock Portfolio Tracker Yahoo Finance

I Received My 1099 B Form From My Stock Trades Is This Saying That I Made 2237 Profit From My Trades R Tax

Cryptocurrency News Japan S Coin Check Makes Investing Easy For Beginners Cryptocurrency Investing Bitcoin

Stock Options Vs Restricted Stock Units Rsus Diligent Equity

Taxes On Stocks How Do They Work Forbes Advisor

Irs Unleashes Global Fatca Data Exchange Offshore Transparency Everywhere Offshore Finance Blog Accounting

20 Million Dollars Check Google Search The Penny Hoarder Extra Money Accounting

Rule 1 Investing Spreadsheet Download Spreadsheet Template Track Investments Spreadsheet

Selling Stock How Capital Gains Are Taxed The Motley Fool

When Filing Tax Returns Where Do You Put Stocks And Bonds

Don T Buy A Car Until You Investing Money Making Hacks Value Investing